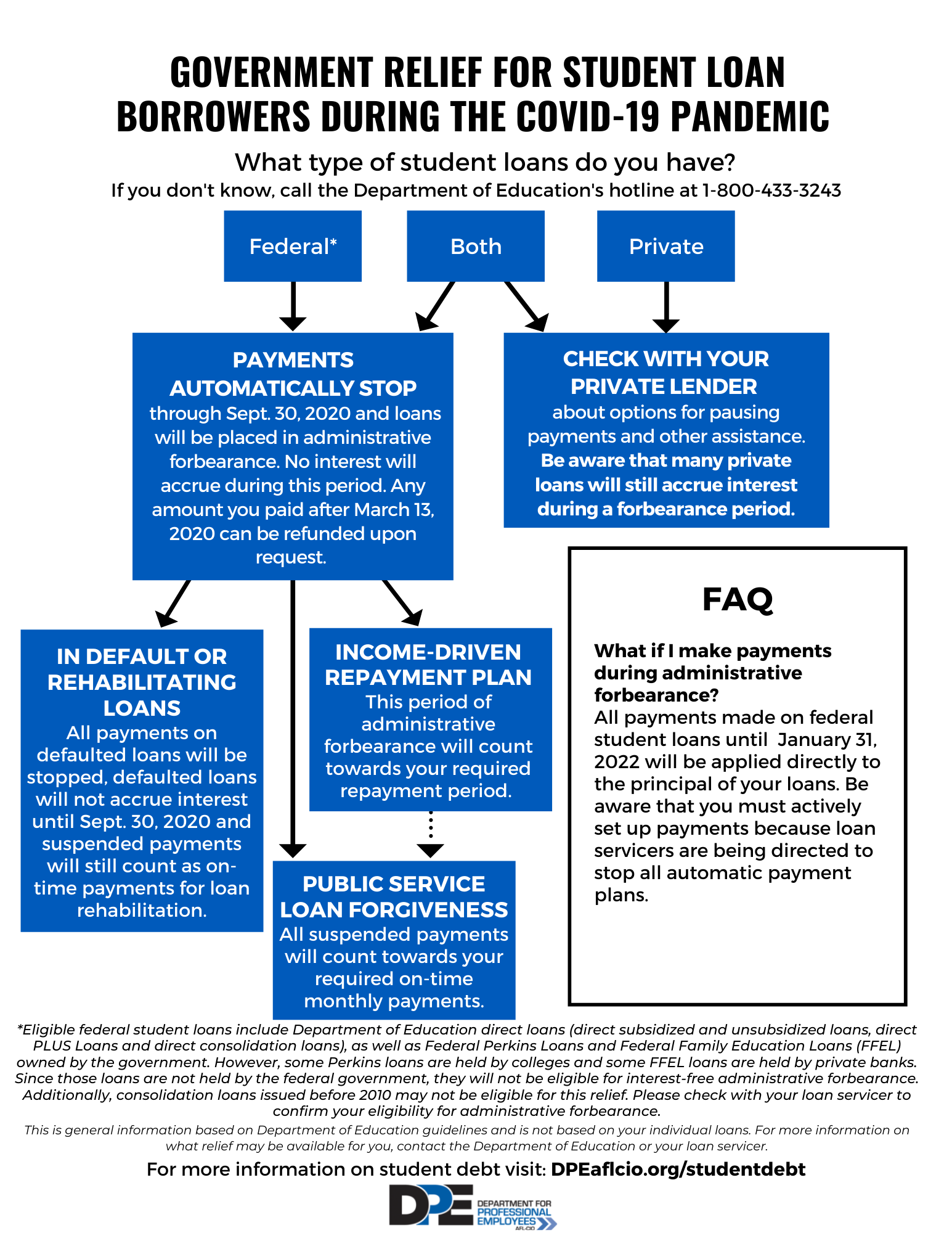

Government Relief for Federal Student Loans During the COVID-19 Pandemic

Do you have federal student loans? Eligible federal student loans include Department of Education direct loans (direct subsidized and unsubsidized loans, direct PLUS Loans and direct consolidation loans), as well as Federal Perkins Loans and Federal Family Education Loans (FFEL) owned by the government. However, some Perkins loans are held by colleges and some FFEL loans are held by private banks. Since those loans are not held by the federal government, they will not be eligible for interest-free administrative forbearance. Additionally, consolidation loans issued before 2010 may not be eligible for this relief. Please check with your loan servicer to confirm your eligibility for administrative forbearance.

Don’t know? Call the Department of Education's hotline at 1-800-433-3243 to find out.

No:

Check with your private lender about the assistance options they are making available during the COVID-19 pandemic, including the ability to pause payments. Be aware that private student loans may still accrue interest during a forbearance period.

Yes:

Your payments will automatically stop through at least Jan. 31, 2022 and your loans will be placed in administrative forbearance. Auto-debits will not run during this period and any amount you paid after March 13, 2020 can be refunded by your servicer upon request. In addition, no interest will accrue on your loans during this period.

FAQ about COVID-19 relief and federal student loans

What if I am in an income-driven repayment (IDR) plan? Will the period of suspended payments count towards IDR forgiveness?

Yes, the period of administrative forbearance will count towards your required repayment period. Additionally, if your pay has been reduced, you should recertify your income in order to qualify for a lower monthly payment once repayment resumes.

I am working towards Public Service Loan Forgiveness. How will this impact me?

As long as you are still working full-time for a qualifying employer during this time, all suspended payments will count towards your required on-time monthly payments.

What happens if I make payments during this period of administrative forbearance?

All payments made on federal student loans until Jan. 31, 2022 will be applied directly to the principal of your loans. Be aware that you must actively set up payments because loan servicers are being directed to stop all automatic payment plans.

What will happen after administrative forbearance ends?

Your loan servicer should contact you before the forbearance period ends to remind you that you need to start making payments again after the administrative forbearance ends. Make sure your loan servicer has your contact information.

This is general information based on Department of Education guidelines and is not based on your individual loans. For more information on what relief may be available for you, contact the Department of Education or your loan servicer.

For more information on professionals and student debt, view our student debt fact sheet.